is missouri a tax free state

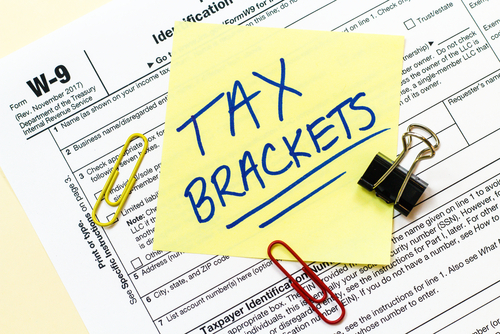

Our property records tool can return a variety of information about your property that affect your property tax. Louis and Kansas City both collect their own earning taxes of 1.

Missouri Income Tax Calculator Smartasset

The Show Me State also has the lowest cigarette taxes in the nation at 17.

. Smart money tips ahead of Tax Day. For instance Tennessee has the highest combined sales tax rate in the nation at 953 according to the Tax Foundation a DC-based think tankWashington state has one of the highest tax rates. Unlike the federal income tax missouriâs state income tax does not you may also electronically file your missouri tax return through a tax preparer or using online tax software and pay your taxes.

2 on taxable income between 1001 and 2000. The stateâs tax revenue per individual is close to 1000 annually. -- Missouri is set to become the last state to require out-of-state online stores to collect sales taxes.

May 14 2021 117 PM. Food is still subject to the Department of Conservation and Department of Natural Resources sales taxes as well as local sales taxes Missouri also imposes a use tax on tangible personal. Certain back-to-school purchases such as clothing school supplies computers and other items as defined by the statute are exempt from sales tax for this time period only.

Residents and anyone who works in either city must pay this tax. Free Online Filing of Federal and State Income Tax Returns through the Free File Alliance. Certain states require forms for CBA purchase cards and CBA travel cards.

Free In-person Audit Support is available only for clients who purchase and use HR Block desktop software solutions to prepare and successfully. Under Missouri state tax laws sales tax is 4225 percent which gasoline tax is 17 cents per gallon. Missouri allows you to purchase the following items tax-free during their annual sales tax holidays.

1 2021 through June 30 2022. The tax increased 25 cents a gallon on Oct. Information for cities counties and districts not.

The measure introduced in late April was designed. Taxes are unavoidable in any state. When you use a Government Purchase Card GPC Click to define.

And while no one enjoys paying taxes they help fund important public services such as roads public schools fire departments and other entities we depend on daily. The largest budget in Missouri history was approved Thursday with money going toward infrastructure improvements and raising teacher salaries. On Friday August 5 and runs through Sunday August 7.

Mogov State of Missouri. In addition to the state tax St. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

But one of the most anticipated items 500 million for a Missouri tax rebate to people who paid state income taxes in 2021 was ultimately vetoed by Gov. Each states tax code is a multifaceted system with many moving parts and Missouri is no exception. 15 on taxable income between 100 and 1000.

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year 2021. To get the refund drivers need to fill out a fuel refund claim form and submit it from July 1 2022 through Sept. Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax.

In 2022 the Sales Tax Holiday begins at 1201 am. The state has no state sales tax but does levy excise taxes including taxes on alcohol and its average property tax rate of 186 of property values is. Gas Tax Refund.

To claim the gas stimulus check from Missouri drivers need to provide details from saved gas receipts of the gas they purchased from Oct. The basics of filing Missouri state taxes. How To Claim It.

A sales tax holiday is an annual event during which the Missouri Taxation Division allows certain items to be purchased sales-tax-free at any participating retailer within the state. Missouris tax system ranks 13th overall on our 2022 State Business Tax Climate Index. Missouri Sales Tax Holiday Calendar.

The state income tax rates range up to 54 and the sales tax rate. The state tax on food however is one percent. Missouris income tax system covers 11 tax brackets.

Missouri imposes a tax on the income of corporations doing business in the state at the rate of 625. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. 50 worth of school supplies 100 in clothing and.

Internet Installment Agreement. File for free with taxact free file. No tax on the first 99 of income.

The state of Missouri requires you to pay taxes if you are a resident or nonresident who receives income from a Missouri source. Missouri has a 4225 percent state sales tax rate a max local sales tax rate of 5763 percent an average combined state and local sales tax rate of 829 percent. They are the only cities in Missouri that.

Http Www Nolo Com Legal Encyclopedia 50 State Guide Internet Sales Tax Laws Html Kansas Missouri New Hampshire Missouri

Missouri Income Tax Rate And Brackets H R Block

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Income Tax Return

Missouri State Taxes For 2022 Tax Season Forbes Advisor

State Corporate Income Tax Rates And Brackets Tax Foundation

Back To School Shopping 2014 Tax Free List By State Usa Back To School Back To School Shopping Teacher Checklist

Missouri State Revenue Liquor Control Tax Stamp Mo L93 Stamp Revenue Stamp Missouri State

Missouri Sales Tax Guide For Businesses

Download And Create Your Own Document With Missouri Quitclaim Deed Form 1 For Free Professional And Printable Templ Quitclaim Deed Missouri Will And Testament

Missouri Mo State Tax Refund Status And Tax Brackets Taxact

2 Inch Yellow Black Smiley Face Patch Emoji Symbol Embroidered Iron On Applique In 2022 Face Patches Emoji Symbols Iron On Applique

2021 Missouri Tax Free Weekend Full Guide Back To School Sales Tax Free Weekend Back To School Sales School Savings

The Absolute Best Place To Grow Up In America Safest Places To Travel Life Map America

23 Washington State 1993 Wyoming Map Us State Map States

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Hawthorn Missouri State Flower Hawthorne Flower Missouri Prairie Garden